Self-Employed vs Business Owner: Which One Are You Really?

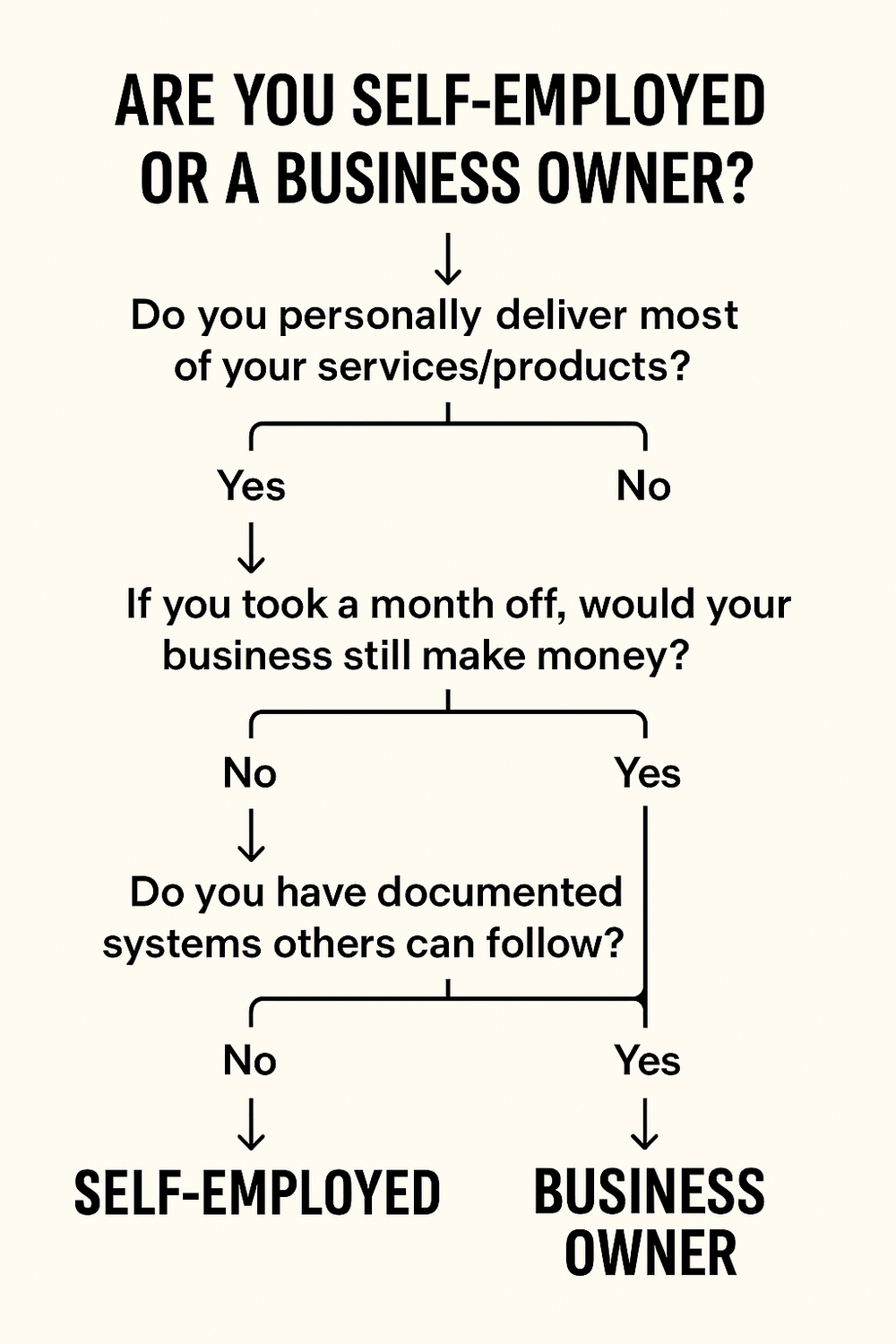

Are you self-employed or a business owner? Do you know the real difference?

Between 2001 and 2019, the UK saw over 1.5 million people become self-employed. Today, about one in eight people earns a living this way. And yet, many professionals still aren’t clear where they stand.

You might call yourself a business owner. But what if you’ve created a job with more admin? I’ve done this myself more than once, so I know how easy it is to fall into the self-employed trap.

Let’s clear things up.

Not sure if you’re building a real business or just staying busy? Grab the free Business Strategy Checklist to find out where your business stands and what to focus on next.

Are you running a business or just working for yourself?

Forget job titles and company structures. The truth about your working status lies in how your business runs without you.

Registering a business doesn’t automatically make you a business owner. The real difference is in your mindset, your systems, and whether your income depends solely on your time.

Solopreneur vs entrepreneur mindset

A solopreneur works solo, doing everything themselves, from sales to delivery. They often stick to what they’re good at and what they can personally handle. This is usually the approach that we start with when we think about moving on from the 9 to 5.

Entrepreneurs take a different approach. They build systems. They hire support. They create structures that allow the business to run and grow without their daily involvement.

Solopreneurs value independence and flexibility. Entrepreneurs value growth and leverage. Both paths are valid, but they create very different futures.

When it comes to the self-employed vs business owner question, mindset is the hidden fork in the road.

The freedom illusion of self-employment

“Be your own boss!” they say. But self-employment often replaces one boss with ten hats. Yes, you pick your hours. But your income depends on more than just doing the work; it depends on finding it, selling it, managing it, delivering it, and doing it again next month.

Here’s what no one tells you:

Your income can stop the moment you stop.

A sick day means no pay.

Taking time off often feels impossible.

You tend to work more than if you had kept your job.

I remember working full-time for one client, thinking I was building a business, but really, I had just swapped one job for another. That setup lasted over a year. I had no backup, no system, and no freedom.

Signs you've created a job, not a business

Here’s the simplest way to tell: If everything stops when you do, you’ve built a job.

Warning signs:

You can’t take holidays without things falling apart.

You make all the decisions and do all the work.

There are no written systems anyone else could follow.

Your business has no resale value.

When my dad died, my so-called business came to a complete standstill. There were no systems, no support, no income. Just me, grieving, overwhelmed, and unable to do anything. That was the moment I realised I hadn’t built a business. I’d built a job that couldn’t survive without me. Even with all my knowledge, I hadn’t followed my own rules.

Download the free Business Strategy Checklist to review the foundation of your business and start shifting toward real ownership.

Understanding your business structure

Your choice of legal structure shapes your business's future. This decision impacts everything from how much tax you pay to your personal liability risks. The structure you pick will define your daily operations and growth potential.

Sole trader vs limited company

Legal structure matters too. It shapes your taxes, liability, and credibility.

Sole Trader

Easy to set up

Profits taxed as income

You are the business, so you carry all risk

Limited Company

Separate legal entity

Offers limited liability

Often more tax-efficient once profits pass ~£25,000–£30,000

Partnerships can work too, but make sure you understand the risk of shared liabilities.

Your setup should support your goals, not trap you in complexity or risk.

Self-Employed vs Small Business Owner

Self-employed people are their business. They deliver the service, do the admin, and manage the client relationships.

Small business owners might still work in the business, but they also work on it. They create jobs, build systems, strategise and slowly reduce their personal involvement.

The shift often starts when you hit capacity. You can’t grow unless you get help, or start turning work away.

How to scale beyond self-employment

Scaling takes intention.

It starts with asking:

What do I need to stop doing?

What would free me up to grow?

Where am I losing money by doing it all myself?

One business owner I spoke to said it best:

"I realised I was losing money by not hiring. That’s when I went looking for help."

Start with Strategic Outsourcing

Bring in freelancers or contractors

Outsource what’s outside your zone of genius

Test the waters before hiring full-time

When you have invested time in your business, it’s easy to think that you know the best way to do things. Honestly, yes, some things you will be the best at, but not everything. For those things, some people are better than you if you just let them in.

Create Repeatable Systems

Document your workflows. Use tools like ClickUp, Monday, or Zapier to automate where you can.

A useful benchmark: Could a new hire complete the task just by following what you’ve documented?

You want to be able to identify and create systems that run without you.

Burnout Is Not a Business Strategy

Many solopreneurs burn out before they ever build. The largest longitudinal study shows 78% of freelancers work even while on holiday, and about 10% never take time off.

Watch out for these:

Working through every holiday

No time off without guilt.

Constantly firefighting instead of planning

Remember, the most important asset in your business is you.

Feeling overwhelmed trying to grow solo? Book a Voxer Strategy Session, let’s untangle the chaos and get your next step clear.

Making the Right Call

Each path has pros and cons:

Employees get stability and perks, but less control

Self-employed individuals get flexibility, but carry all the risk

Business owners build assets, but the early days can be tough

If you want freedom, start building a business, not just a busy calendar.

Ready to shift from solo to CEO? Book a 1:1 Strategy Session and let’s map out a business that works for you (and without you).

Checklist: Signs You've Built a Job, Not a Business

If you stop working, your income stops

You work more hours than when you were employed

You can’t take a holiday without checking in

You handle every client, every task, every decision

There’s no one to delegate to, or no clear process to follow

Your “business” has no value without you

You haven’t documented how things work

You feel like you're constantly firefighting

If you ticked more than 3 boxes, it’s time to look at building a real business, not just staying busy. Start with the free [Business Strategy Checklist].

Final Thought

If you’ve read this far, you already know something needs to shift. Whether you’re still solo or starting to build a team, this is your sign to do it with strategy.

Download the free Business Strategy Checklist to assess where you are now and what needs to change.

Because success isn’t just about doing more, it’s about doing the right things, at the right time, in the right order.

And you don’t have to figure it all out alone.

FAQs

Q1. What’s the main difference between being self-employed and a business owner?

Self-employed people typically deliver services personally. Business owners build systems (and often teams) that work without their constant presence.

Q2. How do I know if I’ve created a job instead of a business?

If your income stops when you stop working, you’ve likely built a job. Other signs: no time off, no systems, and no resale value.

Q3. What are the key differences between sole trader and limited company structures?

Sole traders carry personal liability but have simpler admin. Limited companies offer more protection and can be more tax-efficient at higher profits.

Q4. When should I consider outsourcing or hiring?

When you're losing time or money by doing it all yourself — or need skills you don’t have — it’s time to get support.

Q5. How can I start shifting from self-employed to business owner?

Start by documenting systems, outsourcing tasks, and focusing on high-impact actions. The Business Strategy Checklist will walk you through what to prioritise.

Q6. Is there a step-by-step plan to help me move from solopreneur to business owner?

Yes! Check out the 3-Week Solopreneur to CEO Upgrade Launchpad. A practical, action-packed blueprint to help you shift from solo to strategic leader in just three weeks.

Q7. What’s the right next step for me — freebie, Voxer, or strategy session?

It depends on where you are:

It depends on where you are:

Just getting started? [Download the free Business Strategy Checklist]

Want an affordable, practical roadmap? [Grab the CEO Mindset PDF]

Feeling stuck and need quick clarity? [Book a Voxer Strategy Session]

Ready to scale with guidance? [Let’s build your strategy in a 1:1 session]